Can you get too much of a good thing? Normally we like to think we can't, but in practice we always can. Take economic growth. If we don't get enough of it we have increasing unemployment, we can't pay our health and pension systems, and people generally aren't too happy. But if we get too much of it, we spark off inflation, we become uncompetitive, people stop lending us money, and then all that wonderful growth comes grinding to a halt. The thing is, do we have a "happy mean", and how do we find it. This is normally what people call inflation-free, low unemployment optimal growth, and most of us would give our right hands to find the secret of this. Especially if we happened to be living right now in the Czech Republic, and doubly so if we just happened to be working for the central bank there.

Basically the Czech's have a decision problem, and it isn't an easy one to address. Their economy grew in the fourth quarter of 2007 at what was effectively the fastest pace in two years on the back of increased demand for consumer products and higher public spending on health care and construction works. Gross domestic product expanded year by 6.6 percent year on year during the quater, which compares with a revised 6.3 percent achieved during the third quarter.

And over whole year 2007 the Czech economy grew by a whopping 6.5 percent, following on the back of pretty strong performances in 2005 (6.5%) and 2006 (6.4%).

All of this is evidently very good news, since 6 percent plus growth over a three year period is nothing to be sniffed at, but, on the other hand, if we start to take a bit closer look at some of the data we have seen coming out of the Czech Republic in recent months, and in particular at the data for inflation, wages, and unemployment, we may begin to ask ourselves just how long this particular show can continue, and indeed we may just want to resurrect for ourselves that thorny old chestnut of a question: just what is the inflation-neutral sustainable growth rate for a country with the profile of the Czech Republic?

Inflation Under or Out-of Control?

So let's start with inflation, which dropped back slightly in March for the first time since last July, led by slowing growth in the cost of food and holiday packages. The Czech Republic's annual inflation rate fell to 7.1 percent in March from 7.5 percent in February, when it touched its highest level in a decade, according to data from the Prague-based statistics office earlier today. In fact consumer prices actually fell 0.1 percent from February, when they gained a monthly 0.3 percent over January.

In particular food prices fell back 0.3 percent in the month although they were still 10.8 percent higher than a year earlier. Costs of packaged holidays also fell, by 2.7 percent in the month.

Clearly, despite the fact that the rate of price inflation eased back slightly last month, inflation is still far too high, and there is no real guarantee that it will continue to move down rather than head on up again, unless the economy slows considerably, and this idea of slowing growth is one eventuality that is none to popular with the Czech government or even over at the central bank. So what are the alternatives. Well one restraint on price growth could be the continuing rise in the value of the koruna, which has risen 12 percent gain against the euro since January 2007.

But there are disadvantages to rising currency values, in particular since the impact on export prices may not be that different from actually having the inflation itself, and at the present moment in time the Czech economy is having a pretty successful run of it being an export economy.

And there are also structural dangers involved in letting the koruna rise too far, since in the fisrt place this would attract even more funds to lend to households to fuel consumer demand and construction activity, whilst at the same time weakening the country's burgeoning industrial base. Slowing economic growth - as a result of string of five rate increases from the central bank from the middle of last year - and the waning effect of Jan. 1 tax and regulated price increases are also hoped to have some effect. Indeed it was the combination of these three arguments that lead rate setters at the Czech central banlk to refrain from raising what is still Europe's second-lowest benchmark interest rate last month after raising it to a six-year high of 3.75 percent in February.

The central bank's revised February inflation forecast anticipates an inflation rate of 5.3 percent during the fourth quarter of this year and a 2.4 percent rate by the second quarter of 2009. The preferred mid-point of the central bank's inflation objective is 3 percent. Inflation breached the bank's 4 percent ceiling for a fifth month in a row in March due to the global growth in food and oil costs and a jump of indirect taxes and state-controlled prices such as rents and energy. Policy makers however are inclined to place more emphasis on so-called second-round effects of cost price shocks and tax adjustments such as elevated wage-growth demands that could thwart inflation's return to the desired level.

Indeed this is the interpretation placed on the situation by Czech National Bank board member Eva Zamrazilova speaking at a central bank conference in Prague this morning:

"The data show that the current surge of the inflation rate will be limited by time, the situation will gradually calm down and in early next year, inflation will return to levels very close to our target," she said "Today's figure fully corresponds with an outlook of stable interest rates in the near term"

Things may, however, turn out not to be quite so neat and tidy.

It is true that wage inflation has been slowing, and Czech real wage growth slowed the most in two years in the last quarter of 2007 even as inflation accelerated. The average monthly paycheck rose 1.9 percent when adjusted for inflation, compared with growth of a revised 4.9 percent for the preceding three-month period. The average gross monthly salary advanced 6.8 percent to 23,435 koruna ($1,435). For whole year 2007, real wages were up 4.4 percent, the fastest rate of increase in four years.

Employment and Unemployment

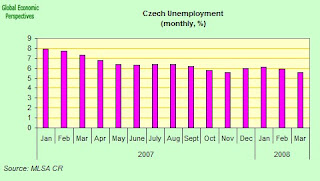

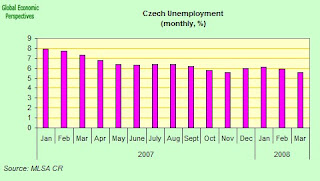

The Czech unemployment rate, on the other hand continues its historic descent, and fell again to 5.6 percent in March as sustained economic growth continued to create more jobs. The rate was down from the 5.9 percent registered in February.

As a result the number of registered unemployed dropped to 336,297, down 18,736 from the preceding month and down 94,177 from a year ago, according to data from the Czech Labor and Social Affairs Ministry earlier this week.

And employment has also been rising rapidly, with the number of first (main) jobholders in Q4 2007 reaching 4 967.3 thousand, up by 105.6 thousand (+2.2%) year-on-year. Employment thus reached it highest level since the start of 1997.

One evident consequence of this steady increase in employment and decline in unemployment is that labour shortages are now a growing reality in the Czech Republic, and one clear indication of this is the fact that the number of unfilled job vacancies is also steadily increasing, hitting a record 151,311 at the end of last month.

So with the Czech economy creating jobs at a rate of over 100,000 a year, and with unemployment falling at 95,000 a year, and realistically assuming that not all the 300,000 or so unemployed who remain are employable, then the Czech Republic may be what, 18 months or so away from running out of workers at this point. Of course, long before you actually get to run out of workers, you hit the limits of the inflation-free rate of growth which is possible with the workforce which remains, as we have been seeing in one East European economy after another, (and as we may now even be seeing in China). This is why the recent surge in Czech inflation, despite the slight fall back this month, should be giving some cause for concern over at the central bank.

And the situation is in fact even more complicated than these numbers reveal, since if we look at the chart below, which shows a breakdown of the Czech 2007 population by five-year age groups, then we can see that the largest cohort is now in the 30 to 34 age group, and after this each subsequent group has less people coming up behind them. Worse, the 55 to 59 age cohort is significantly larger than either the 15 to 19 one or the 20 to 24 one, which means that as people retire there will increasingly be less people entering the labour market to replace them, and especially since the tendency is for young people to spend an increasing number of years in training and education.

The root of the problem here is long term fertility, which only really crashed to very low levels in the 1990s, but which has, as can be seen in the chart, been hovering nervously below the replacement level since the late 1960s (with some ups and downs).

The result of this is the number of children being born has been dropping back continuously since the mid 1970s, and it is this process more than anything else which gives the current Czech population structure its very peculiar present shape.

So Is Migration The Answer?

Certainly migration can help (as can increasing participation rates among older workers) but the numbers involved are really quite large for a comparatively small country, and there are issues about preparedness to adapt to becoming a multi-cultural society (everything in Eastern Europe is just happening so quickly). The changeover is, however, taking place and foreigners now make up almost 4 percent of the Czech Republic's population (which is currently a little over 10 million), with the number of migrant workers in the country rising steadily year by year, and in particular in 2007. According to data from the Czech Statistical Office at the end of last year there were a total of 392,100 foreigners with long-term or permanent residence permits living in the Czech Republic. This was up by 70,600 in 2007 alone.

The largest group of foreign migrants with rights to work in the Czech Republic comes from Slovakia. At the end of last year, 101,233 Slovakians were legally worrking in the country. Ukranians are the second most numerous group with 61,592 working in the Czech Republic last year. The number Mongolian and Vietnamese workers is also increasing rapidly. In 2007 there were 6,897 Mongolians working legally in the CR (up from 2814 in 2006) and 5,4425 Vietnamese (up from 692 in 2006). The numbers of Vietnamese actually in the country is undoubtedly much larger, and according to the Czech police, there are almost 51,000 Vietnamese holding long-term or permanent residence permits for the CR, many of them with temporary student visas. Demand in Vietnam is also way up, and the Czech embassy in Hanoi had to close its doors to visa applicants temporarily in March to reorganise itself in order to cope with the influx.

It is evident that the Czech Republic's labour shortages are now making their present felt across the economy as a whole, and the world of business is now waking up to the implications of this situation. Bloomberg had an in-depth article earlier in the week, where they quoted Jiri Cerny, vice president of Toyot and PSA Peugeot Citroen's joint venture in the Czech Republic, as saying that three years after opening shop in the country he feels it is getting harder by the day to find workers, as a result he is now actively considering importing them from Mongolia.

TPCA, the Toyota-Peugeot joint venture about an hour outside of Prague, shows the strains created by this new investment. Along with average wage growth of more than 40 percent since the Czech Republic joined the EU in 2004, managers like Cerny also face a labor shortage that means they can't recruit all the workers they need just by offering higher pay.

"It's difficult; we are always looking for employees," says Cerny, wearing the plant's trademark gray overalls as he bounces between budget meetings and the factory floor. To find qualified workers, "we're thinking about Vietnam right now, as well as Mongolia," he says.

This story is being repeated in one country after another across Eastern Europe as companies that were attracted by the promise of cheap and plentiful labor are finding less of both, as faster growth drives up wages and open borders encourage emigration. Indeed there is increasing speculation that accelerating inflation may cause eastern Europe's investment- led boom to fizzle (and possibly even crash to a dead stop), with the Baltics and Balkans regions already threatened by a "hard landing" according to the International Monetary Fund and Standard & Poor's.

Of course in the short term migration will undoubtedly help, but in the longer run sustainability is going to be all about getting that fertility rate back up again, at least to something approaching replacement level, otherwise "catch up" economic growth will be simply unsustainable, while the pension and health systems will buckle under the weight of the large elderly population.

Update Thursday 10 April 2008Development since I wrote this post only serve to confirm just how complex all of this is now becoming. This morning Czech central bank Governor Zdenek Tuma has an interview in the magazine HVG. He exxplaines in the interview that Czech monetary policy makers have kept interest rates down as low as possible in order to try to avoid excessive strengthening of the Korune. The central bank, which last met on March 26 and kept the 14-day repurchase rate at 3.75 percent, expects the inflation rate to fall to 5 percent by September and 3 percent next year from 7.5 percent in February, Tuma told the Budapest-based magazine.

``The low interest rate-level isn't surprising when you look at the past few months,'' he said in the interview published today. ``When an economy is catching up to a more advanced region, its national currency usually appreciates. That's what's happening in the Czech Republic.''

At the same time the Czech Cabinet have approved this week an agreement with the central bank designed to avoid putting more pressure on the koruna, so that it does not start weighing excessively on exports. The plan, submitted by Finance Minister Miroslav Kalousek, was passed by ministers at a weekly meeting in Prague yesterdat, reviving a similar arrangement made in 2002.

The objective is to keep the foreign-currency proceeds from state asset sales and European Union funds off the market to limit demand for the koruna. The plan is the result of an ``agreement with the Czech central bank on a series of measures which should work against the trend of the appreciating koruna,'' Kalousek told reporters.

The Czech government plans to sell state assets such as the national airline Ceske Aerolinie AS as early as this year. The government also wants to sell Lestiste Praha AS, operator of Prague's international airport, which could generate as much as 100 billion koruna ($6.3 billion). Kalousek said revenue from sales of state assets will be frozen on a foreign exchange account at the central bank and kept for an overhaul of the pension system. If the government needs part of the funds, it would use foreign exchange swaps until it adopts the euro in the future, he added.

If the Finance Ministry was to issue Eurobonds then ``we will hedge them so they have no impact on exchange rate developments.''

This is a reference to a ministry statement last December that it may sell euro-denominated debt this year with a value equal to no more than 50 percent of its annual borrowing needs of 180 billion koruna, depending on market conditions.

The Czechs are also entitled to receive as much as 26.7 billion euros ($42.1 billion) in EU funds during the period of 2007 to 2013. Kalousek said he is not in favour of hedging funds coming from the European Union as that would contribute to koruna appreciation and would weigh on exporters.

It ``would mean a transfer of all of the negative impacts on Czech exporters,'' he said. ``Both the public and private sectors must share exchange rate risks.''